Driving Efficiency with Tax Administration Technology

- Posted by admin

- On 11/11/2024

- 0 Comments

In today’s fast-paced and complex financial environment, the role of technology in tax administration has become indispensable. Businesses and governments are increasingly leveraging advanced technologies to streamline tax compliance, enhance accuracy, and ensure transparency. This article delves into the various advancements in tax technology, the benefits they bring, the challenges faced during implementation, and future trends, drawing on insights from multiple industry reports.

The Need for Technological Transformation

The traditional methods of tax administration, which rely heavily on manual processes, are no longer adequate to handle the intricacies of modern tax regulations. These manual methods are prone to errors, inefficiencies, and heightened risks of non-compliance. To address these challenges effectively, the integration of advanced technologies is essential. Such technologies automate processes, enhance accuracy, and provide real-time data analysis, thereby transforming the tax administration landscape.

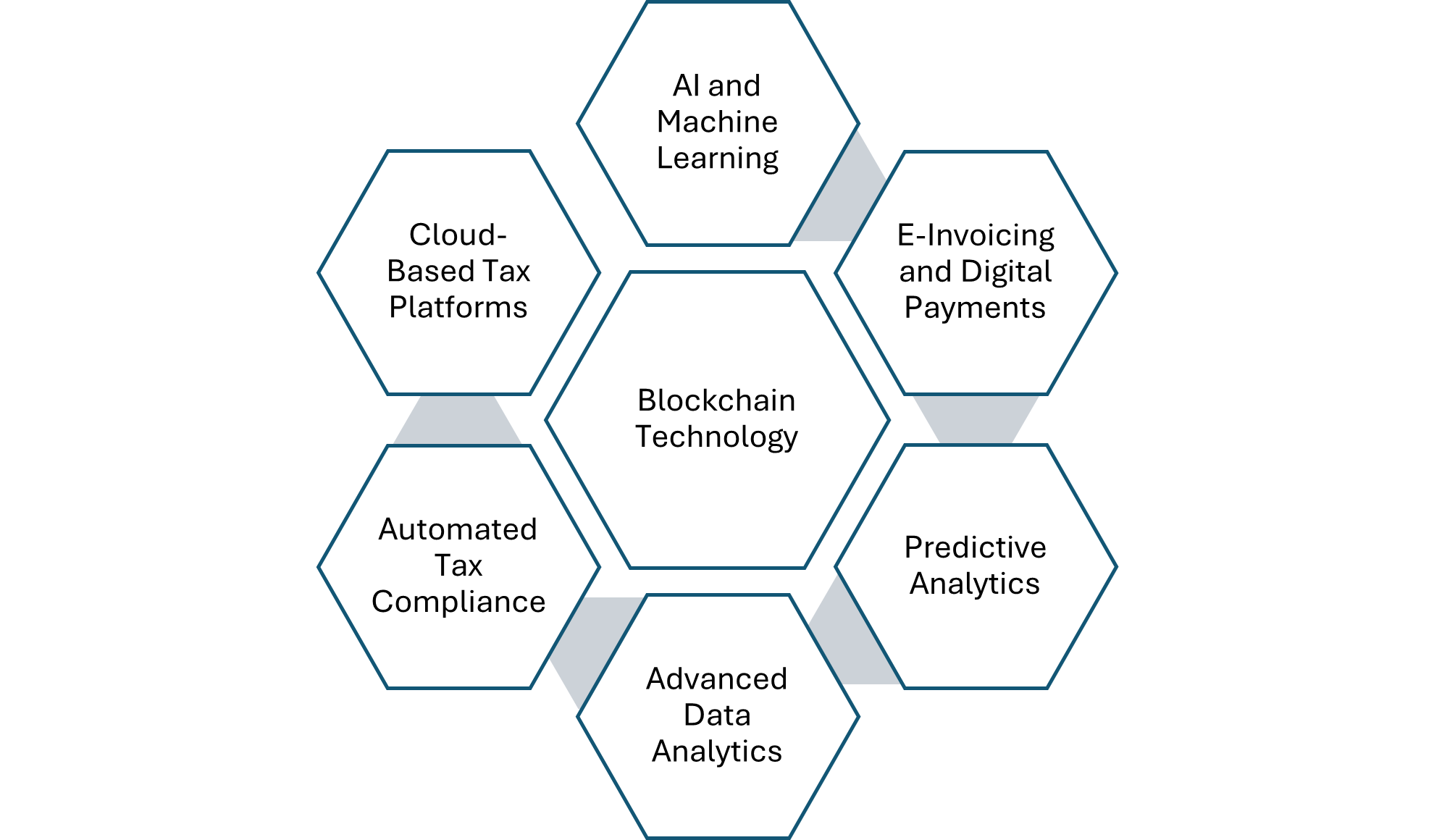

Key Technological Advancements

- Automated Tax Compliance

Robotic Process Automation (RPA) is at the forefront of automating routine compliance tasks. By handling processes such as filing returns, generating reports, and managing data entry, RPA minimizes human errors and boosts operational efficiency. This automation not only saves time but also ensures consistency in compliance-related activities.

- Advanced Data Analytics

Big Data and Analytics play a crucial role in modern tax administration. By analyzing large datasets, tax authorities can monitor tax filings, detect anomalies, and identify potential fraud. Machine learning algorithms further enhance these capabilities by predicting tax liabilities and optimizing tax planning, leading to more informed decision-making.

- Blockchain Technology

Blockchain provides a secure and transparent ledger for tax-related transactions. This technology enhances data integrity, reduces the risk of fraud, and builds trust between taxpayers and tax authorities. By ensuring that all transactions are immutable and verifiable, blockchain fosters a more reliable tax system.

- Cloud-Based Tax Platforms

Cloud solutions offer real-time access to tax information and seamless integration across different tax functions. These platforms ensure compliance with the latest regulations and provide a scalable infrastructure that can adapt to changing needs. The use of cloud technology simplifies tax management and enhances the responsiveness of tax authorities.

- AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning are revolutionizing tax administration by providing decision support, risk assessments, and scenario analysis. These technologies automate the interpretation of complex tax laws, improving accuracy and reducing the burden on human resources. AI-driven tools help in identifying patterns and trends that may not be evident through traditional analysis.

- E-Invoicing and Digital Payments

Electronic invoicing systems streamline compliance with Goods and Services Tax (GST). By digitizing the invoicing process, these systems reduce paperwork, enhance accuracy, and ensure timely tax payments. Digital payment platforms further support this by enabling secure and efficient transactions.

- Predictive Analytics

Predictive models are invaluable in forecasting tax revenues and identifying compliance risks. By leveraging historical data and advanced algorithms, these models provide tax authorities with insights that support proactive decision-making and effective tax strategy development.

- Mobile Tax Applications

Mobile apps enhance taxpayer engagement by providing convenient access to tax services. Through these applications, taxpayers can file returns, make payments, and access tax-related information from anywhere, at any time. This convenience improves compliance rates and fosters a more taxpayer-friendly environment.

- Integrated Tax Management Systems

Comprehensive tax management systems connect various tax functions into a single platform. This integration improves data accuracy, ensures compliance, and enhances operational efficiency. By providing a unified view of tax activities, these systems facilitate better coordination and management of tax processes.

- Electronic Records Management

Digital record-keeping systems ensure that tax records are easily accessible, well-organized, and compliant with regulatory requirements. These systems support efficient audits and investigations by providing quick access to historical data and reducing the risk of lost or misplaced documents.

- AI for Audits and Compliance

AI-driven audits enhance the effectiveness of tax audits by quickly analyzing vast datasets, identifying discrepancies, and ensuring regulatory compliance. These automated systems improve the accuracy and speed of audits, reducing the burden on tax authorities and taxpayers alike.

Benefits of Tax Administration Technology

- Enhanced Compliance

Technology-driven tax administration ensures timely and accurate tax filings, reducing the risk of non-compliance and associated penalties. Automated systems can keep track of regulatory changes and update tax calculations accordingly, ensuring compliance with the latest tax laws.

- Cost Efficiency

By automating routine tasks and minimizing manual interventions, tax administration technology lowers operational costs. This efficiency gain is significant for organizations with complex tax structures and multiple compliance requirements, enabling them to allocate resources more effectively.

- Data Accuracy and Security

Advanced technologies minimize human errors and enhance the accuracy of tax data. Blockchain and AI provide robust security features that protect sensitive tax information from breaches and fraud, ensuring the accuracy and security of tax data.

- Improved Decision-Making

Real-time data analytics and predictive insights empower tax professionals to make informed decisions. These technologies offer a comprehensive view of the tax landscape, allowing businesses to optimize their tax strategies and identify opportunities for savings.

- Challenges and Considerations

While the benefits of tax administration technology are clear, several challenges must be addressed to fully realize these benefits:

- Implementation Costs

The initial investment in tax technology can be substantial, particularly for small and medium-sized enterprises (SMEs). However, the long-term benefits, such as improved efficiency and reduced compliance costs, often outweigh the upfront investment.

- Integration with Existing Systems

Integrating new technologies with legacy systems can be complex and time-consuming. Organizations must carefully plan and execute the integration process to ensure a smooth transition without disrupting ongoing operations.

- Data Privacy and Security

While technology can enhance data security, it also introduces new risks. Organizations must implement robust cybersecurity measures to protect against data breaches and ensure compliance with data privacy regulations.

- Skilled Workforce

Effective use of advanced tax technologies requires a workforce with specialized skills in data analytics, AI, and blockchain. Organizations need to invest in training and development to equip their employees with the necessary expertise to leverage these technologies effectively.

Case Studies and Industry Insights

- Connected Tax Compliance

Integrated tax solutions that connect different parts of the tax function enable real-time data sharing and collaboration, enhancing overall tax efficiency and compliance. For example, a global corporation implemented an integrated tax platform that connected its tax, finance, and IT departments, resulting in improved data accuracy and compliance rates.

- Tax Technology Transformation

Transforming tax functions from compliance-focused to strategic involves using RPA, AI, and data analytics to create a more agile and responsive tax function. A multinational enterprise successfully transformed its tax function by implementing AI-driven analytics tools, leading to more informed decision-making and better risk management.

- Income Tax Digitalization in India

Digitalization is reshaping income tax administration in India, with increasing adoption of e-filing, digital payments, and automated compliance checks. This has improved tax collection efficiency and reduced administrative burdens. For instance, the Indian government’s introduction of the e-assessment scheme has streamlined the tax assessment process, reducing the time taken for assessments and increasing transparency.

- Tax Technology Solutions

Various tax technology solutions are designed to enhance compliance and efficiency, including cloud-based tax platforms, AI-driven analytics, and blockchain solutions for secure transaction recording. A financial services firm adopted a cloud-based tax solution that provided real-time updates on regulatory changes, ensuring compliance and reducing manual effort.

Future Trends

The future of tax administration technology is promising, with ongoing advancements in AI, blockchain, and data analytics set to further enhance tax compliance and efficiency. Emerging technologies such as quantum computing and advanced encryption methods will provide even more robust security and data processing capabilities. Additionally, the increasing focus on Environmental, Social, and Governance (ESG) factors will drive the development of tax technologies that support sustainable and responsible tax practices.

Conclusion

Tax administration technology is revolutionizing the way businesses manage their tax obligations, offering significant benefits in terms of compliance, cost efficiency, data accuracy, and decision-making. While challenges remain, the continued evolution of these technologies promises to further enhance the efficiency and integrity of tax administration. By embracing these advancements, businesses can navigate the complexities of the tax landscape with greater confidence and agility.

0 Comments