Managing GST Rate Changes: A Sectoral Approach in India

- Posted by kalyani

- On 07/10/2024

- 0 Comments

The Goods and Services Tax (GST) in India, implemented on July 1, 2017, revolutionized the indirect tax system by unifying various central and state taxes into a single tax framework. This unification aimed to streamline tax compliance, increase transparency, and eliminate the cascading effect of multiple taxes. However, frequent GST rate changes pose significant challenges for businesses across different sectors. These changes necessitate continuous adaptation in pricing strategies, compliance measures, and overall operational adjustments.

Understanding GST Rate Changes

GST rates represent the percentage of tax levied on the sale of goods or services under the Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), and Integrated Goods and Services Tax (IGST) Acts. Businesses registered under GST law are required to issue tax invoices that include the GST amounts charged on the value of the supply. For intrastate transactions, the GST rates for CGST and SGST are typically similar. In contrast, for interstate transactions, the GST rate for IGST is generally the combined total of the CGST and SGST rates.

Types of GST Rates and GST Rate Structure in India

The primary GST slabs for regular taxpayers are currently set at 0% (nil-rated), 5%, 12%, 18%, and 28%. Additionally, there are a few less common GST rates, such as 3% and 0.25%.

Composition taxable persons pay GST at lower or nominal rates, typically 1%,2% 5%, or 6% on their turnover. GST also includes Tax Deducted at Source (TDS) and Tax Collected at Source (TCS), with rates set at 2% and 1%, respectively.

These GST rates apply to the total IGST for interstate supply or the combined CGST and SGST rates for intrastate supply. The GST rate is multiplied by the taxable value of the supply to determine the GST amount on a tax invoice.

Furthermore, the GST law imposes an additional cess on certain items such as cigarettes, tobacco, aerated water, petrol, and motor vehicles. These cess rates vary significantly, ranging from 1% to 290%. Additionally, there are special rates for items like precious metals and certain luxury goods.

The GST Council, which comprises representatives from both the central and state governments, meets periodically to review and adjust these rates based on economic conditions, industry feedback, and revenue needs. These changes aim to balance the twin objectives of revenue generation and economic growth but can lead to operational complexities for businesses.

Impact of GST Rates on Business Strategies

GST has fundamentally transformed India’s tax landscape by replacing multiple indirect taxes with a unified tax system. Central to this system is the GST rate structure, which influences every facet of the economy. Grasping the impact of GST rates on business strategies is crucial for businesses to devise effective financial plans, pricing strategies, and compliance measures. This comprehensive discussion delves into the various ways GST rates shape business strategies, including pricing, supply chain management, and overall financial planning.

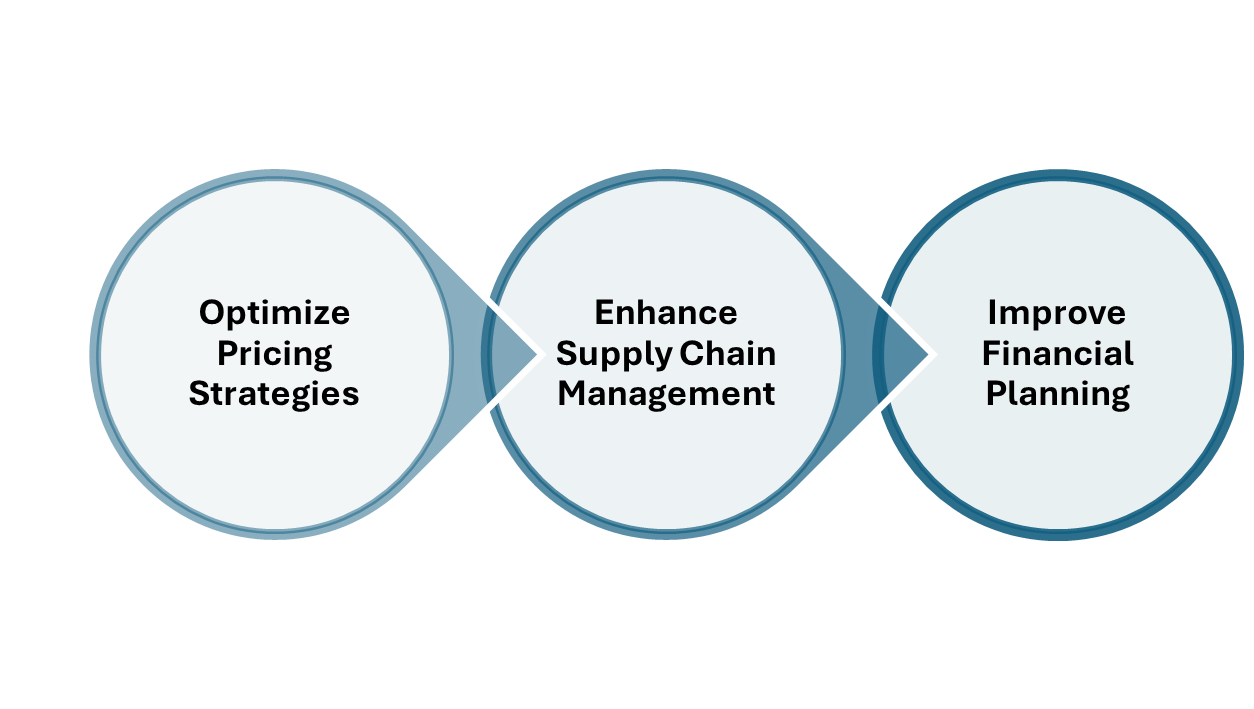

Understanding GST rates allows businesses to:

- Optimize Pricing Strategies: Adjust pricing models to reflect the cost implications of different GST rates, ensuring competitive yet profitable pricing.

- Enhance Supply Chain Management: Streamline supply chain operations to leverage tax benefits and minimize tax liabilities.

- Improve Financial Planning: Integrate GST rate considerations into financial forecasts and budgets to ensure robust financial health and compliance.

Impact on Key Sectors

Manufacturing

Challenges:

The manufacturing sector, characterized by extensive supply chains and production processes, is highly sensitive to GST rate changes. Such changes can lead to immediate cost variations in raw materials and components, which subsequently affect the pricing of final products. Additionally, the sector faces complexities in claiming Input Tax Credit (ITC), which is crucial for maintaining cash flow and ensuring tax compliance.

Strategies:

Inventory Management:

Manufacturers should adopt robust inventory management practices to quickly adapt to GST rate changes. By maintaining optimal inventory levels, businesses can mitigate the impact of sudden rate hikes or reductions.

Contract Review:

Regularly reviewing and updating contracts with suppliers and customers to include GST clauses helps manage rate changes efficiently. This ensures that any tax burden can be appropriately passed on or absorbed, depending on the terms of the contract. Furthermore, clear communication with all stakeholders about potential GST rate changes can foster transparency and smoother transitions.

Technology Integration:

Implementing advanced Enterprise Resource Planning (ERP) systems that can update GST rates in real-time assists in accurate billing and compliance. Such systems also streamline the ITC process, reducing the risk of errors and delays. Additionally, these ERP systems can generate detailed GST reports and analytics, aiding in strategic decision-making and improving overall operational efficiency.

Retail

Challenges:

The retail sector deals with the direct consumer market, making it imperative to adjust prices promptly with any GST rate changes. Retailers with extensive product lines face the daunting task of updating prices across various platforms, including physical stores and e-commerce sites.

Strategies:

Dynamic Pricing:

Utilizing dynamic pricing algorithms that automatically adjust prices based on GST rate changes can help retailers maintain profitability without manual intervention. These algorithms analyze various factors, including supply chain costs and competitive pricing, to set optimal prices.

Customer Communication:

Transparent communication with customers about price changes due to GST rate adjustments helps maintain trust and avoid confusion. Retailers can use in-store signage, digital notifications, and marketing campaigns to inform customers. Moreover, providing clear explanations about the reasons behind the price adjustments can enhance customer understanding and acceptance of the changes.

Staff Training:

Regular training for staff on handling GST changes ensures that compliance is maintained at all levels, from billing to returns. Staff should be equipped to explain GST-related price changes to customers and handle any queries or concerns.

Services

Challenges:

The services sector, including IT, banking, and telecommunications, often deals with long-term contracts. Changes in GST rates can affect ongoing service agreements, requiring amendments to existing contracts and recalculations of service costs.

Strategies:

Contract Management:

Implementing flexible contract management systems that allow for adjustments based on GST rate changes can help service providers manage compliance efficiently. These systems should facilitate easy modifications and re-negotiations of contract terms.

Billing Adjustments:

Automated billing systems that can update rates as per the latest GST notifications ensure accurate invoicing and reduce the risk of non-compliance. These systems should also generate detailed reports for audit purposes.

Client Education:

Keeping clients informed about the implications of GST rate changes on their services helps in smoother transitions and maintains client relationships. Regular updates through newsletters, webinars, and client meetings can be effective in maintaining transparency and trust.

Real Estate

Challenges:

The real estate sector is heavily impacted by GST rate changes, particularly in the context of construction materials and services. Rate changes can significantly alter project costs, affecting both affordability and demand in the market.

Strategies:

Cost Management:

Developers need to adopt cost management practices that account for potential GST fluctuations. This includes securing fixed-rate contracts for materials and services wherever possible to hedge against future rate changes. Additionally, maintaining a contingency fund specifically earmarked for GST-related expenses can provide a financial buffer and ensure project stability amidst regulatory uncertainties.

Financial Planning:

Robust financial planning and maintaining contingency reserves can help absorb the impact of unexpected GST rate changes. Developers should regularly review their financial models to incorporate potential tax changes.

Regulatory Compliance:

Staying updated with the latest GST amendments and ensuring compliance across all project stages is crucial. This involves regular consultation with tax experts and continuous monitoring of regulatory updates. Conducting internal audits periodically can help identify any potential compliance gaps and address them promptly, reducing the risk of penalties or legal issues.

Policy Recommendations for Effective Management

- Advance Notification

Providing advance notice of GST rate changes would allow businesses sufficient time to adjust their pricing strategies, update systems, and communicate changes to stakeholders. A predetermined notice period can help minimize disruptions and facilitate smoother transitions.

- Sector-Specific Committees

Establishing sector-specific committees within the GST Council can help understand the unique challenges faced by different industries. These committees can provide tailored recommendations for rate adjustments that minimize disruptions and support sectoral growth.

- Simplified Compliance Procedures

Simplifying compliance procedures, particularly for Small and Medium Enterprises (SMEs), can ease the burden of managing GST rate changes. Streamlined processes for ITC claims, filing returns, and obtaining clarifications can enhance compliance and reduce administrative overheads.

- Technology-Driven Solutions

Encouraging the adoption of technology-driven solutions like GST compliance software can help businesses manage rate changes more efficiently. The government can support this through subsidies or tax incentives for technology investments, promoting a more digital and efficient compliance ecosystem.

- Stakeholder Engagement and Feedback Mechanisms

Establishing robust stakeholder engagement mechanisms, including regular consultations with industry associations, consumer groups, and tax experts, can foster a collaborative approach to GST management. Soliciting feedback on proposed rate changes and compliance procedures ensures that policies are responsive to the needs and concerns of all stakeholders, leading to more effective implementation and greater overall compliance.

Conclusion

Managing GST rate changes in India requires a sectoral approach that recognizes the unique challenges and needs of different industries. While rate changes are inevitable in a dynamic economic environment, businesses can mitigate their impact through strategic planning, technology integration, and proactive communication. Policymakers, on their part, can support businesses by providing advance notifications, establishing sector-specific committees, and simplifying compliance procedures. Through a collaborative effort, India can ensure that its GST regime continues to drive economic growth while minimizing disruptions for businesses. Additionally, investing in training programs for businesses on GST compliance can foster a more knowledgeable and well-equipped business community.

0 Comments