Role of Digitalization in Transfer Pricing Compliance

- Posted by admin

- On 10/23/2024

- 0 Comments

Digitalization is transforming transfer pricing compliance, introducing efficiencies, enhancing transparency, and minimizing risks. Multinational corporations (MNCs) now leverage advanced technologies to navigate the complexities of transfer pricing regulations, ensuring robust compliance and reducing the likelihood of penalties.

Introduction to Transfer Pricing Compliance

Transfer pricing involves the pricing of transactions between related entities within an MNC to ensure these transactions adhere to the arm’s length principle, as if conducted between unrelated parties. Compliance with transfer pricing regulations is critical to avoid penalties and adjustments by tax authorities. Traditional methods of managing transfer pricing compliance are often labor-intensive and fraught with risks, necessitating a shift towards digital solutions.

The arm’s length principle ensures that transactions between related parties are conducted as if they were unrelated, preventing profit shifting to low-tax jurisdictions.

Challenges of Traditional Transfer Pricing Compliance

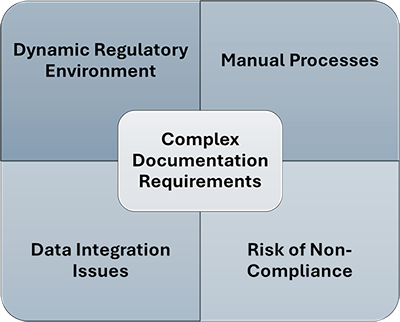

Complex Documentation Requirements

Transfer pricing compliance necessitates the preparation of comprehensive documentation to demonstrate that transactions between related entities are conducted at arm’s length. This involves detailed analysis, including:

- Functional Analysis: Assessing the functions performed, risks assumed, and assets used by each entity involved in the transaction.

- Economic Analysis: Comparing the controlled transactions with those conducted between independent entities in similar circumstances.

Dynamic Regulatory Environment

The transfer pricing regulatory landscape is continuously evolving, with frequent updates to guidelines and regulations by tax authorities worldwide. This dynamic environment poses significant challenges:

- Continuous Monitoring: Companies must continuously monitor regulatory changes and adapt their transfer pricing policies accordingly.

- Global Consistency: Ensuring consistency in transfer pricing policies across different jurisdictions while complying with local regulations.

Manual Processes

Traditional transfer pricing compliance often relies on manual processes for data collection, analysis, and reporting:

- Time-Consuming: Manual processes are labor-intensive and time-consuming, requiring significant resources.

- Prone to Errors: The reliance on manual calculations increases the risk of errors, leading to potential non-compliance.

Data Integration Issues

Effective transfer pricing compliance requires the integration of financial data from various sources across different departments and geographies. Challenges include:

- Data Fragmentation: Inconsistent and fragmented data complicates the consolidation and analysis process.

- Data Quality: Ensuring the accuracy and completeness of data is critical for reliable transfer pricing analysis.

Risk of Non-Compliance

Failure to comply with transfer pricing regulations can have severe consequences:

- Penalties: Non-compliance can result in substantial penalties and interest charges.

- Financial Adjustments: Tax authorities may impose significant adjustments to taxable income, impacting the company’s financial position.

- Reputation Damage: Non-compliance can damage the company’s reputation and strain relationships with tax authorities.

The Digital Transformation in Transfer Pricing Compliance

Digitalization introduces advanced technologies that significantly enhance and streamline transfer pricing compliance processes. Here’s how:

Automation

Digital tools automate the preparation and maintenance of transfer pricing documentation, greatly reducing manual effort and improving accuracy. This includes the generation of reports, data entry, and compliance checks, ensuring consistent and precise documentation.

Data Integration and Analytics

Advanced data analytics tools enable the seamless integration and analysis of vast amounts of financial data. This aids in accurate transfer pricing evaluations by consolidating data from different sources and applying sophisticated algorithms to identify patterns, trends, and discrepancies.

Real-Time Monitoring

Digital systems offer continuous, real-time monitoring of transactions, which allows companies to manage compliance proactively. This real-time oversight helps in identifying and addressing potential issues promptly, ensuring that all transactions adhere to transfer pricing policies.

Enhanced Risk Assessment

Digital tools facilitate improved risk assessment through comprehensive analysis of historical data, market trends, and economic conditions. By leveraging machine learning and predictive analytics, these tools can assess the potential risks associated with transfer pricing strategies and recommend adjustments to mitigate them.

Improved Collaboration

Digital platforms enhance communication and collaboration among various departments and subsidiaries. These platforms ensure that all relevant stakeholders are aligned and informed, promoting better decision-making and consistency in transfer pricing practices. They enable seamless sharing of information, documentation, and insights across the organization, fostering a collaborative approach to compliance.

Benefits of Digitalization in Transfer Pricing

Efficiency and Accuracy

The automation of documentation and reporting processes ensures higher efficiency and accuracy, reducing the time and resources required for compliance. This also minimizes the risk of human error, leading to more reliable and consistent outcomes.

Compliance and Transparency

Real-time monitoring and advanced analytics enhance compliance by ensuring that all transactions are continuously checked against regulatory requirements. This transparency not only helps in meeting regulatory standards but also builds trust with tax authorities and stakeholders.

Cost Savings

By automating and optimizing compliance processes, companies can achieve significant cost savings. Reduced manual effort, fewer errors, and streamlined operations translate into lower administrative costs and more efficient use of resources.

Proactive Compliance Management

With continuous monitoring and advanced risk assessment, companies can adopt a proactive approach to compliance. This means potential issues are identified and addressed before they escalate, reducing the likelihood of penalties and audits.

Strategic Decision-Making

Improved data integration and analytics provide deeper insights into financial performance and transfer pricing strategies. This empowers companies to make informed, strategic decisions that align with their overall business objectives and regulatory requirements.

Conclusion

Digitalization plays a critical role in transforming transfer pricing compliance, addressing the myriad challenges posed by traditional methods. By leveraging automation, advanced analytics, real-time monitoring, enhanced risk assessment, and improved collaboration, companies can streamline their compliance processes, ensure accuracy, and maintain proactive management of their transfer pricing strategies. This not only helps in meeting regulatory requirements but also fosters a culture of transparency, efficiency, and strategic alignment, positioning companies for sustained success in a complex and dynamic global market.

0 Comments