Transfer Pricing: Staying Ahead of Regulatory Changes in India

- Posted by kalyani

- On 06/05/2024

- 0 Comments

Transfer pricing has become a critical element in the international tax law, particularly for multinational corporations (MNCs) operating in multiple jurisdictions. Every country has been strengthening transfer pricing regulations in order to address the issue of tax base erosion and profit shifting (BEPS) and ensure that profits are appropriately taxed where economic activities are performed. In India too, the transfer pricing regulations have evolved significantly in recent years. Accordingly, planning the intra-group transactions by MNCs such as transfer of goods or services, transfer and / or use of intellectual properties, financial transactions, business restructurings, etc. and undertaking appropriate compliances in the respective jurisdictions has now become more relevant particularly from the overall tax cost standpoint and heavy penal implications.

Transfer Pricing Regulatory Landscape in India

Evolution of Transfer Pricing Regulations

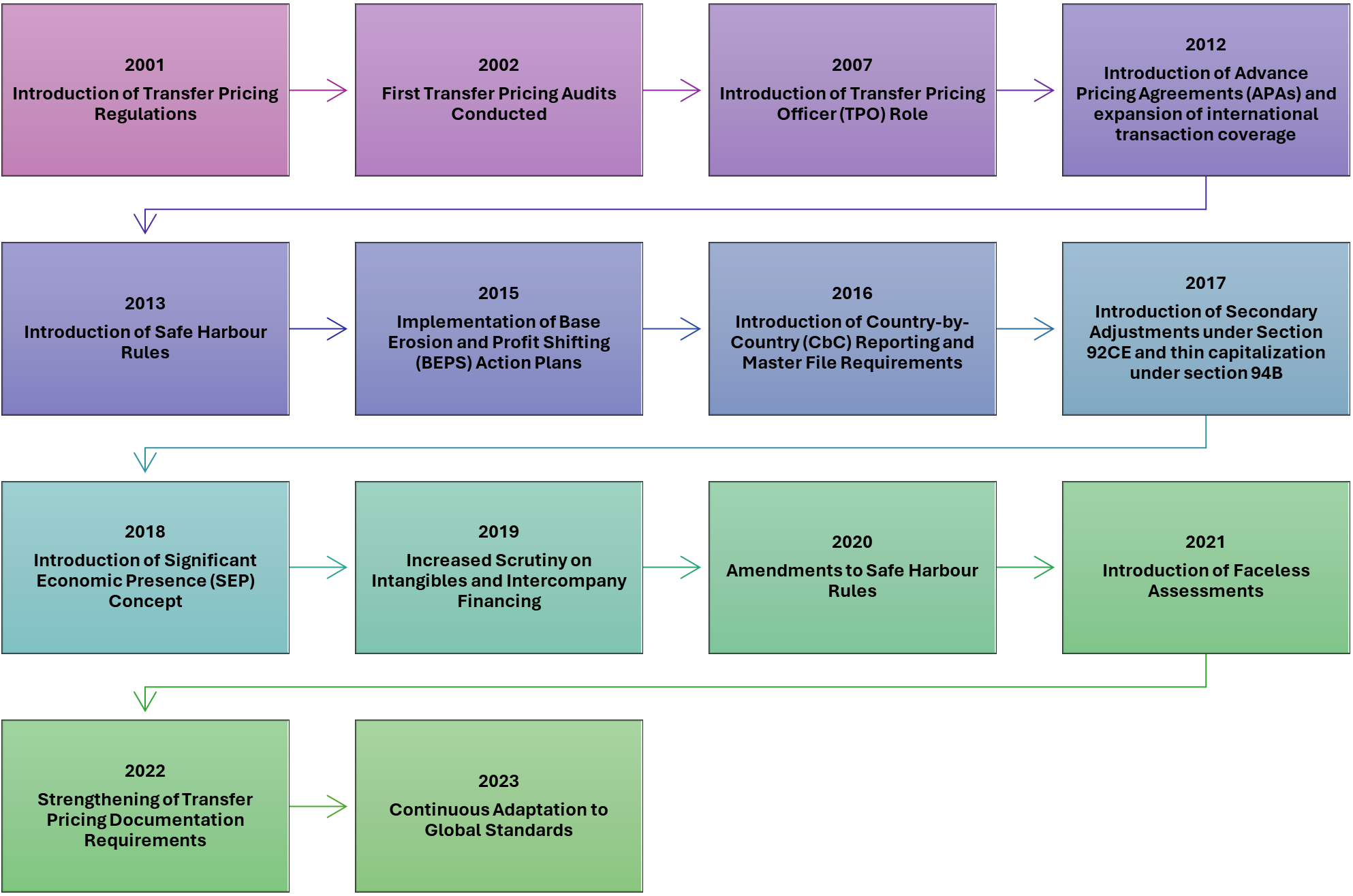

India introduced its transfer pricing regulations in 2001 under Sections 92 to 92F of the Income Tax Act, 1961. These regulations require MNCs to ensure that international transactions with associated enterprises are conducted at arm’s length prices. The arm’s length principle aims to ensure that related entities transact as if they were unrelated parties, thereby preventing profit shifting to low-tax jurisdictions.

Illustration: Infographic: Timeline of evolution of transfer pricing regulations

The Impact of BEPS and OECD Guidelines

India has been an active participant in the OECD’s BEPS project, which seeks to combat tax avoidance strategies that exploit gaps and mismatches in tax rules. The BEPS project resulted in 15 action plans, many of which have been incorporated into Indian tax laws (including transfer pricing regulations). Key BEPS action plans related to transfer pricing include:

-

- Action 8-10: These actions address transfer pricing issues related to intangibles, risks, and capital. They emphasize the need for accurate delineation of transactions and alignment of transfer pricing outcomes with value creation.

- Action 13: This action introduces Master File compliance and country-by-country (CbC) reporting by large MNCs for greater information with tax authorities such as group overview, presence, value chain analysis, location of intangibles, breakdown of revenue, profit, and tax paid for each jurisdiction in which they operate.

Recent Developments in Indian Transfer Pricing Regulations

India has introduced several changes to its transfer pricing regulations to align with international standards and address BEPS concerns. Key developments include:

-

- Master File and CbC Reporting: In line with BEPS Action 13, India has mandated the filing of a Master File and CbC report. The Master File provides an overview of the global business operations, transfer pricing policies, and allocation of income among entities. The CbC report provides a detailed breakdown of revenue, profit, and taxes paid in each jurisdiction.

- Secondary Adjustment under section 92CE: The introduction of secondary adjustments under Section 92CE requires MNCs to make an actual payment or receive an adjustment to align the primary adjustment with the arm’s length price.

- Thin capitalization under section 94B: In line with the recommendations of OECD BEPS Action Plan, section 94B was introduced for limitation on interest deduction in certain cases. As per Section 94B, expenditure with respect to interest paid to associated enterprises shall be restricted to 30% of the Assessee’s earnings before interest, taxes, depreciation and amortization (EBITDA) or interest paid or payable to associated enterprise, whichever is less.

- Introduction of Safe Harbour Rules: To simplify compliance, India introduced Safe Harbour Rules, providing MNCs with an option to declare certain transactions at a pre-determined arm’s length price.

- Advance Pricing Agreement (APA): As per section 92CC, the Central Board of Direct Taxes (with the approval of the Indian Government) may enter into Unilateral or Bilateral APA determining ALP or manner in which ALP is to be determined, in relation to international transaction entered into by the taxpayer. Up to March 2023, 516 APAs have been entered into by the Board (420 unilateral and 96 bilateral). Additionally, 125 APAs were entered into by the Board during FY 2023-24 (86 unilateral and 39 bilateral).

Anticipating Future Regulatory Developments

-

- Increased Focus on Digital Economy

With the rapid growth of the digital economy, tax authorities worldwide, including India, are focusing on ensuring that digital businesses pay their fair share of taxes. India has introduced the concept of “significant economic presence” to tax digital companies, even if they do not have a physical presence in the country. Future regulatory changes may further refine these rules to capture the digital economy’s value effectively.

-

- Strengthening Anti-Avoidance Measures

India is likely to continue strengthening its anti-avoidance measures to combat BEPS. This could include more stringent documentation requirements, enhanced information sharing between tax authorities, and greater scrutiny of intercompany transactions involving intangibles, intercompany financing, and risk allocation.

-

- Adoption of Advanced Analytical Techniques

Tax authorities are increasingly using advanced analytical techniques, such as data analytics and artificial intelligence, to identify transfer pricing risks and anomalies. Companies should anticipate greater scrutiny of their transfer pricing arrangements and be prepared to defend their positions with robust data and documentation.

Implementing Robust Transfer Pricing Strategies

-

- Conducting Regular Transfer Pricing Audits

To stay ahead of regulatory changes, taxpayers should conduct regular transfer pricing audits. These audits help identify potential risks and ensure that transfer pricing policies are aligned with the latest regulatory requirements. By proactively addressing any issues, taxpayers can avoid costly disputes and penalties.

-

- Strengthening Documentation and Reporting

Robust documentation is critical for defending transfer pricing positions. Taxpayers should maintain detailed records of their transfer pricing policies, including the rationale for their pricing decisions, economic analyses, and supporting data. This documentation should be regularly updated to reflect changes in business operations and regulatory requirements.

-

- Leveraging Technology and Data Analytics

The use of technology and data analytics can enhance the accuracy and defensibility of transfer pricing policies. Advanced analytics can help taxpayers identify trends, benchmark their pricing against industry standards, and detect potential risks. Additionally, technology can streamline the documentation process, making it easier to maintain and update records.

-

- Engaging with Tax Authorities

Proactive engagement with tax authorities can help companies navigate regulatory changes and reduce the risk of disputes. By participating in advance pricing agreements (APAs) and mutual agreement procedures (MAPs), taxpayers can gain certainty over their transfer pricing arrangements and avoid double taxation.

Case Studies: Navigating Regulatory Changes in India

Infosys and Transfer Pricing Adjustments

Infosys, a global IT services company headquartered in India, faced significant scrutiny over its transfer pricing practices. The company was involved in a high-profile dispute with the Indian tax authorities, resulting in a transfer pricing adjustment of approximately INR 1,100 crores (about USD 150 million). Infosys proactively revised its transfer pricing policies to align with regulatory changes and settled the dispute through the APA program, gaining certainty over its future transfer pricing arrangements.

Maruti Suzuki and the Importance of Documentation

Maruti Suzuki, a leading automobile manufacturer in India, encountered challenges with its transfer pricing practices, particularly regarding royalty payments to its Japanese parent company. The Indian tax authorities questioned the arm’s length nature of these payments, resulting in a transfer pricing adjustment. Maruti Suzuki strengthened its documentation and engaged in a MAP with the Indian tax authorities, ultimately resolving the dispute and ensuring compliance with transfer pricing regulations.

Conclusion

Staying ahead of regulatory changes in transfer pricing in India requires a proactive and strategic approach. Taxpayers must continuously monitor the regulatory landscape, anticipate future developments, and implement robust transfer pricing strategies. By conducting regular audits, strengthening documentation, leveraging technology, and engaging with tax authorities, MNCs can ensure compliance and minimize the risk of disputes. As transfer pricing regulations continue to evolve, MNCs that prioritize transparency, economic substance, and data-driven decision-making will be best positioned to navigate the complex global tax environment.

0 Comments